The Framework

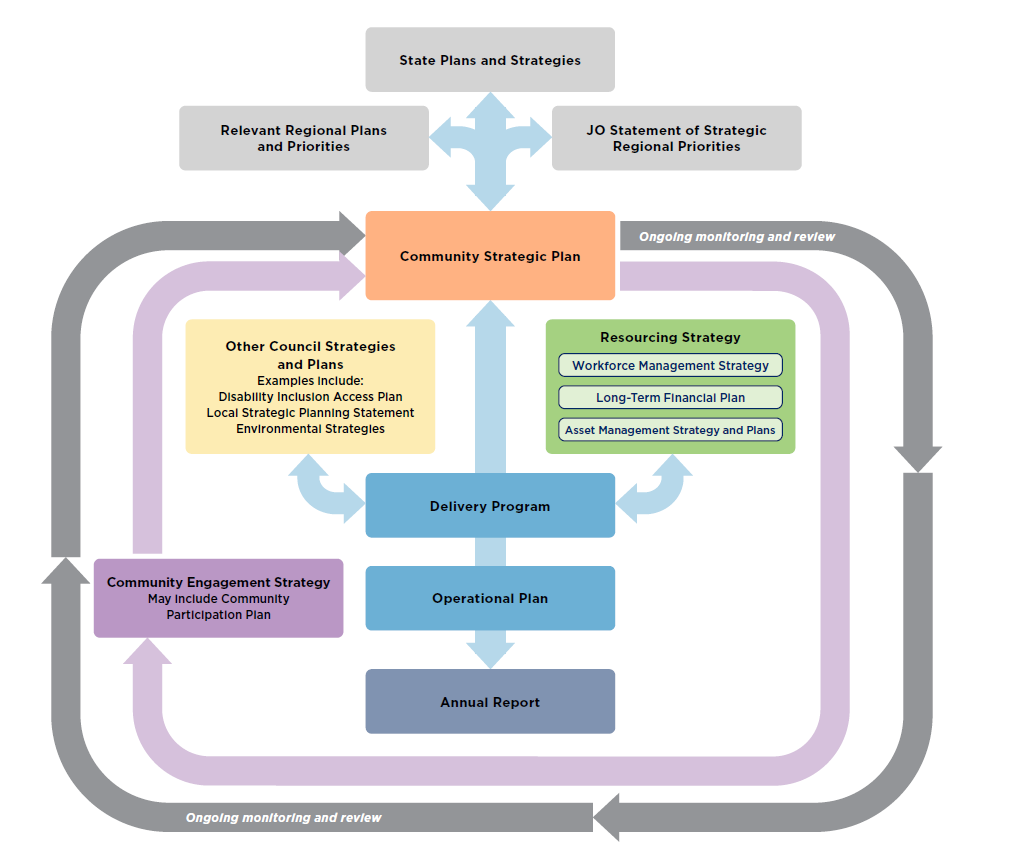

The Integrated Planning and Reporting (IP&R) framework changed the way Councils in NSW planned, documented and reported on their plans for the future. The Framework came into practice in 2009 and many councils have refined the way they create and review these plans over the subsequent years. The following pages and links provide information on what the Framework involves and how to implement it.

In essence the IP&R Framework begins with the community’s, not councils, aspirations for a period of at least 10 years. It includes a suite of integrated plans that set out a vision and goals and strategic actions to achieve them. It involves a reporting structure to communicate progress to council and the community as well as a structured timeline for review to ensure the goals and actions are still relevant.

In this section you will find more information on each of the documents and how they integrate, links to information about government priorities, how to work with your community to understand their aspirations, as well as review and reporting.

The key two guiding documents on IP&R are the

If you have questions about the Framework please phone our team on (02) 4428 4100 or email olg@olg.nsw.gov.au

The Process

Information in this section of the website has been provided to assist councils to implement the Integrated Planning and Reporting Framework.

In addition to providing resources such as IPR Guidelines, Manual and Checklist, we have also provided top tips for Councils, better practice examples, information about roles and responsibilities, suggested timeframes, specific requirements for County Councils and tips for integrating plans.

A closed Facebook page has been established for NSW local government IP&R practitioners to share good practice and resource ideas, ask and answer questions about IP&R, and generally be a space for IP&R discussion. To be invited to join this page, please send a request from your NSW council email address to ipr@olg.nsw.gov.au.

Good practice examples

There is no perfect suite of council plans, the intent of these better practice examples is to provide council practitioners, councillors and community members with a range of examples of how a council might undertake its planning

You are encouraged to tell us about other examples of good practice so we can add it to this site, and everyone can benefit.

Links

Suggested timeframes for the IP&R cycle

Support for implementation of IP&R Framework

This section contains information to support councils in their implementation of the Integrated Planning and Reporting framework. The page contains links to key resources rather than detailed information. Councils are also encouraged to share their ideas and successes with one another, for example by informing other NSW councils when plans and strategies are published.

Links

Integrated Planning and Reporting Resources